This month, Scottish Government released a publication detailing how £12.7 billion of general funding was distributed to Scotland’s 32 councils for 2020-21. The funding distribution considered 168 service areas listed in the Local Government Finance Green Book and was agreed by the 32 councils and the Convention of Scottish Local Authorities (COSLA).

The map below shows the total allocation per person per council of this funding.

The funding comes from three sources. The maps below show the different allocations per person per council from these sources.

Allocation from council tax

Council tax rates are based on an historical valuation of houses with each house placed into one of eight bands (A-H). Councils can vary the level of council tax, but it is Scottish Government that then estimates the revenue (£2.4 billion) raised.

Allocation from non-domestic rates

Non-domestic rates are charged on all businesses and other organisations that use properties. The rate level is set by Scottish Government and the revenue (£2.8 billion) is forecasted by the Scottish Fiscal Commission.

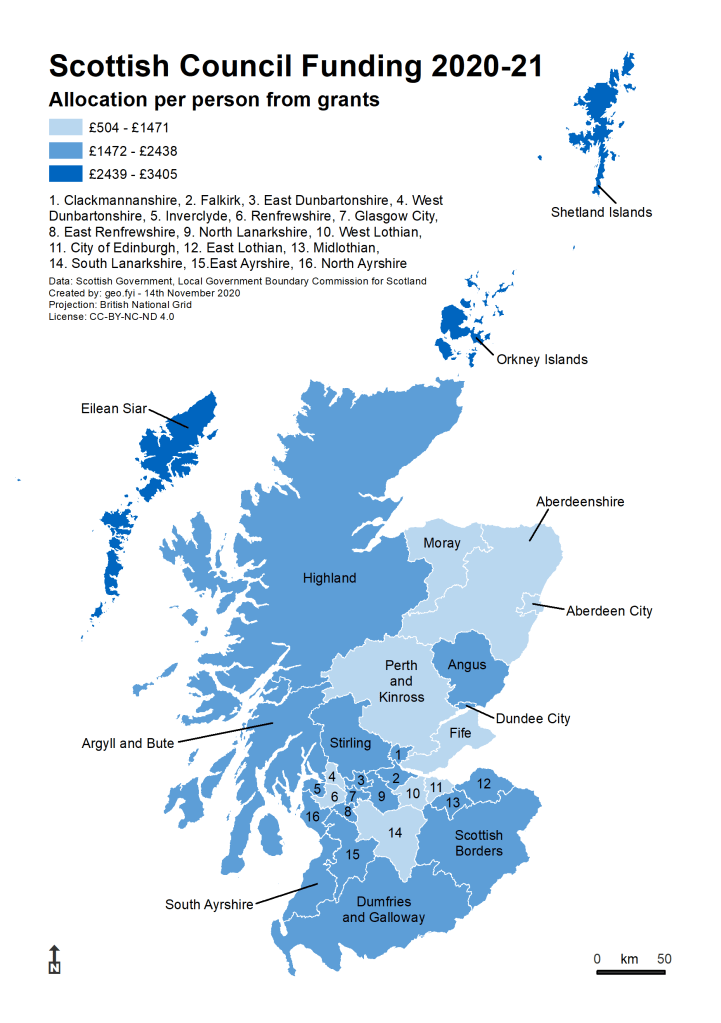

Allocation from Scottish Government grants

Scottish Government provides a General Revenue Grant (GRG) which makes up the difference between a councils spending assessment for providing standard service levels and their council tax plus non-domestic rate income.

Note: An additional £380 million of funding was made available due to the Covid-19 pandemic but is not included in the figures mapped.